S. Korean Shipbuilders Eying US Navy Frigate Program?

South Korean media report rumors of Hanwha and HD Hyundai targeting US Navy frigate program; both firms have already begun implementing plans for US market entry

The US Navy’s (USN) recent decision to cancel the Constellation-class frigate program has sent shockwaves through the defense industrial base. What was supposed to be a low-risk adaptation of a proven FREMM design became a cautionary tale about the dangers of feature creep and design instability.

But where there’s a vacuum, there’s opportunity.

For the first time in history, South Korean naval shipbuilders — Hanwha Ocean and HD Hyundai Heavy Industries — are rumored to be positioning themselves as active participants in the construction of a USN surface combatant, potentially stepping in as vital options to expand America’s naval shipbuilding capacity.

As 10 U.S.C. § 8679 strictly prohibits the construction of USN vessels in foreign yards, both Hanwha and HD Hyundai have spent recent years examining various pathways to access the US market. More recently, both firms have begun to take concrete steps that could allow their participation in the USN’s upcoming “Plan B” frigate program.

HD Hyundai’s Partnership with HII

On October 26, 2025, HD Hyundai signed a strategic Memorandum of Agreement (MOA) with Huntington Ingalls Industries (HII), an approach designed to leverage HII’s existing US footprint and HD Hyundai’s technical expertise.

HII built all 10 units of the Legend-class National Security Cutters (NSC), a design reportedly favored by Navy Secretary John Phelan to replace the Constellation. HD Hyundai would likely serve as a force multiplier, providing advanced engineering, supply chain optimization, and modular manufacturing expertise to HII’s shipyard operations.

Pros:

Production Readiness: HII possesses the tooling, molds, and production engineering data for the NSC. While the line was idled following the cancellation of the 11th cutter in June 2025, the institutional knowledge likely remains intact.

Manufacturing Excellence: HD Hyundai brings world-class shipbuilding efficiency and advanced construction techniques that could accelerate production timelines and reduce costs.

Cons:

Integration Challenges: Without a formal joint venture or ownership stake, HD Hyundai essentially operates as a high-level consultant. Integrating South Korean production methodologies into an established US shipyard’s culture presents significant coordination hurdles.

Capacity Conflicts: HII is already operating at capacity with high-priority programs, such as USN destroyers and amphibs. Surging frigate production on the same footprint could risk delays to other critical programs.

Hanwha’s Hybrid Play

Hanwha has pursued a more aggressive, two-pronged approach, as follows:

Partnership: Hanwha can leverage its stake in Austal to form a production partnership. Austal USA operates a modern facility in Mobile, Alabama, capable of accommodating vessels of comparable displacement.

Ownership: Hanwha can utilize its wholly-owned Philly Shipyard to manufacture hull modules for distributed production, creating a build model under direct Hanwha control.

Pros:

Industrial Ownership: Hanwha has genuine “skin in the game.” As an owner of Philly Shipyard and the largest shareholder in Austal, the company can drive efficiency reforms and technology transfer more directly than the HD Hyundai-HII arrangement may allow.

Dedicated Focus: Austal USA faces fewer constraints from legacy Tier-1 programs compared to HII. A frigate program here would likely command the yard’s primary attention.

Cons:

Design Translation: Austal USA lacks HII’s NSC production engineering expertise. Translating HII’s build strategy to Austal USA’s production line may require noticeable adaptation, potentially introducing technical risk.

Deepening Complexity: While these arrangements embed Hanwha more deeply into the US industrial base, greater integration could bring proportionally greater regulatory, security, and cultural challenges.

The Wildcard: The KDX-2 Option

Regardless of which yard is selected, the question of ship design remains paramount. If the modified NSC proves too small or difficult to up-gun, the USN might seek an off-the-shelf foreign design better suited to operational requirements. However, any path the USN chooses will likely mirror the Constellation strategy: adapting an existing foreign design to meet USN requirements.

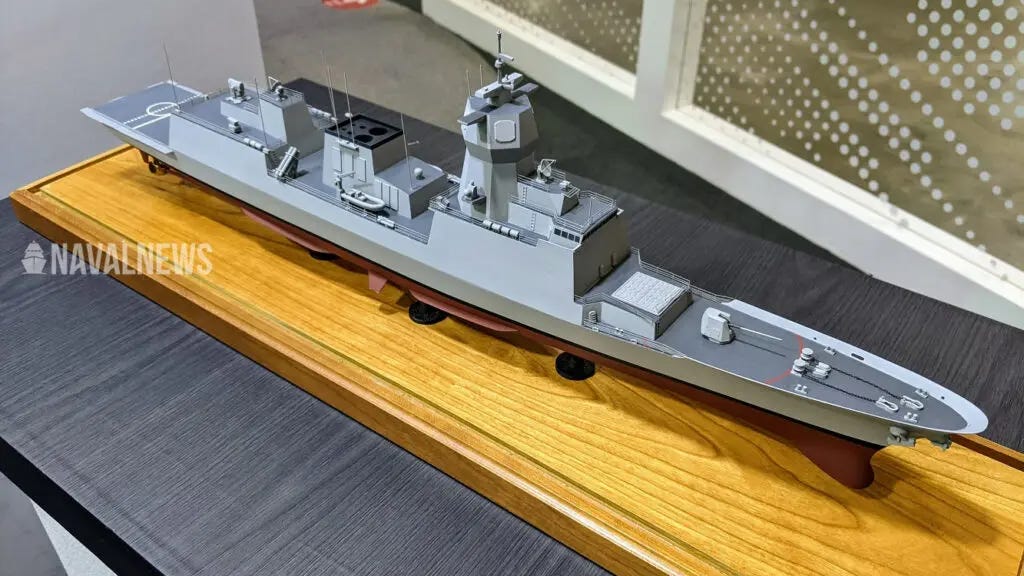

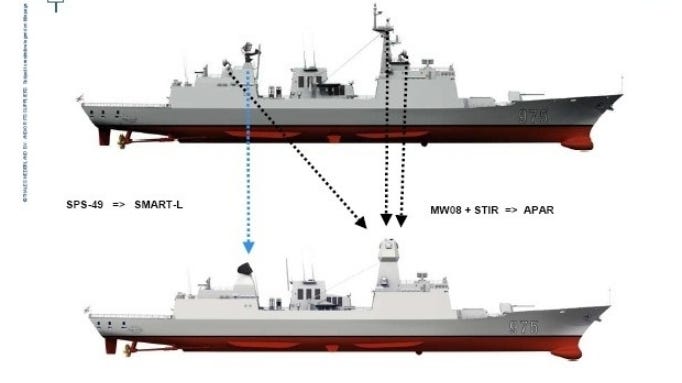

While I won’t advocate on behalf of any particular design, I believe the South Korean KDX-2 destroyer design merits consideration.

As the blue-water workhorse of the Republic of Korea Navy (ROKN), the KDX-2 is a proven platform with robust vertical launch system (VLS) capacity that the NSC lacks. Among ROKN surface warfare officers, the KDX-2 is highly regarded for its exceptional seakeeping. In terms of displacement, it is roughly in the same category as the FREMM design.

In the past, Lockheed Martin (AEGIS/SPY-7) and Thales (APAR/SMART-L) have each offered modified KDX-2 designs capable of accommodating the weight and volume of a sizable fixed radar system. A modernized KDX-2 built in Mobile or Pascagoula with South Korean technical oversight could be a worthwhile alternative to examine.

Conclusion

The expected entry of Hanwha and HD Hyundai into the US naval industrial base represents a paradigm shift. They are not merely competitors but potential force multipliers offering the USN viable alternative options.

Both companies are reportedly eyeing further acquisitions. HD Hyundai has been exploring US shipyards to match Hanwha’s aggressive footprint, while Hanwha officials have publicly stated their intention to expand US shipbuilding capacity via more acquisitions.

Alongside incumbent players like Fincantieri and General Dynamics, these new partnerships could usher in a transformative era for US naval shipbuilding.